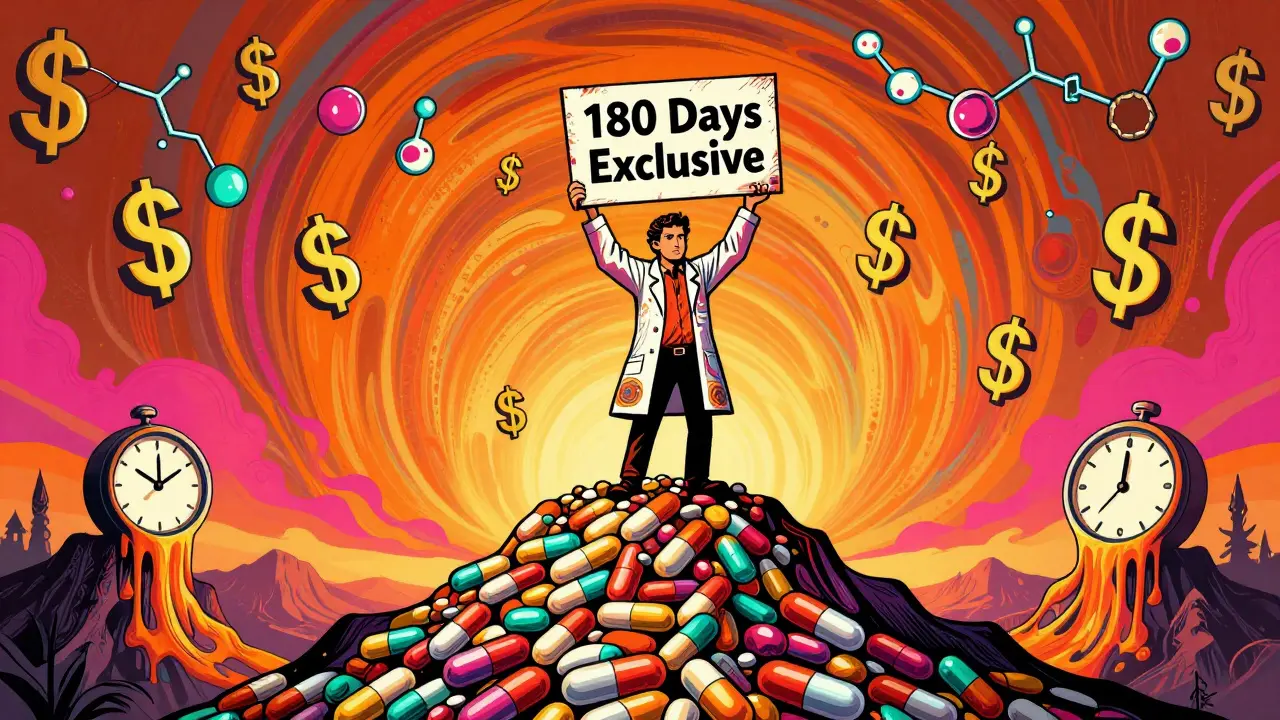

When the first generic version of a brand-name drug hits the market, it doesn’t just lower prices-it starts a chain reaction. The first company to win a patent challenge gets 180 days of exclusive rights to sell that generic. During that time, they charge 70-90% of the original brand price and capture 70-80% of the market. That’s a gold rush. But once those 180 days are up, everything changes. Competitors flood in. And prices don’t just drop-they collapse.

Why the First Generic Has a Big Advantage

The Hatch-Waxman Act of 1984 created the rules that still govern generic drug entry today. It wasn’t meant to punish brand companies-it was meant to speed up access to cheaper drugs. The 180-day exclusivity period is the incentive: if you’re willing to spend $5-10 million on litigation to challenge a patent, you get a head start. That’s the only time in the entire lifecycle of a drug where a generic manufacturer can charge near-brand prices without competition. During those six months, the first generic isn’t just selling pills-they’re building relationships with pharmacy benefit managers (PBMs), securing shelf space in hospitals, and locking in contracts. By the time the second entrant arrives, the first one already has 80% of the business. That’s not luck. It’s strategy.How the Second and Third Generics Break the Mold

The moment exclusivity ends, prices start to plummet. The FDA found that with one generic, prices are at 83% of the brand. With two, they drop to 66%. With three, they’re at 49%. The biggest plunge? Between the second and third entrant. That’s when the market flips from "cheap" to "rock-bottom." Take Crestor (rosuvastatin). When the first generic launched in 2016, it sold for $280 a month. By the time eight manufacturers were selling it, the price was $10. That’s a 96% drop in 18 months. That kind of collapse doesn’t happen because of goodwill. It happens because every new entrant is trying to grab market share by undercutting the last one. But here’s the catch: not every company can jump in right away. Some wait. Others don’t even try. Why? Because the cost to enter isn’t just about making the drug. It’s about navigating a broken system.Authorized Generics: The Brand’s Secret Weapon

One of the most underreported tactics? Authorized generics. These aren’t knockoffs. They’re the brand company selling the exact same drug-same factory, same formula-under a generic label. And they often launch on day one of the first generic’s exclusivity period. Merck did this with Januvia in December 2019. On the exact day the first generic entered, Merck’s authorized generic hit shelves. Within six months, it captured 32% of the market. The original generic’s share dropped from 80% to 45%. Revenue for the first entrant? Cut by nearly 40%. The FDA says 65% of big-brand drugs use this tactic. It’s legal. It’s smart. And it’s devastating for the first generic. You spent millions challenging the patent, only to have the brand company undercut you with the same product. No wonder some generic makers now avoid high-value markets altogether.

Why More Generics Don’t Always Mean Lower Prices

You’d think more competitors = cheaper drugs. But that’s not always true. In oncology, even with five generics on the market, prices stay at 35-40% of the brand. Why? Because those drugs require special handling, cold storage, and trained staff. Fewer companies want to make them. So competition stays low. Cardiovascular generics? They’re the opposite. With five competitors, prices drop to 12-15% of the brand. That’s because they’re simple to make. Everyone can do it. So the race to the bottom is brutal. And then there’s the problem of shortages. The FDA reports that 62% of generic drug shortages happen in markets with three or more manufacturers. Why? Because when prices collapse, margins vanish. Manufacturers cut corners. Quality control slips. One bad batch from a contract manufacturer shuts down production for everyone. And since most second- and third-wave generics rely on shared contract labs (78% do, versus 45% of first entrants), one failure can ripple through the whole system.Who’s Winning in the New Generic Game?

The old model-"be first, win big"-is fading. Today, there are two kinds of winners:- Innovation players: These companies focus on complex generics-injectables, inhalers, topical creams-that take years to develop and have few competitors. They charge more because they can.

- Efficiency players: These are the volume traders. They make simple pills by the millions. They win by being the cheapest, fastest, and most reliable. But their margins are razor-thin.

Legal Delays and Regulatory Hurdles

It’s not just about money. It’s about time. Brand companies file citizen petitions to delay generic entry. Between 2018 and 2022, they filed over 1,200 of them. Each one adds an average of 8.3 months to the timeline. Many target drugs that already have one generic approved, hoping to scare off the next entrant. Then there’s the CREATES Act. Passed in 2020, it forced brand companies to provide drug samples to generic makers. Before, some brands refused to sell samples-blocking bioequivalence testing. Now, it takes 4.3 months on average to get them, down from 18.7. That’s a win for competition. But patent settlements are still a wildcard. In 2022, 65% of patent deals included staggered entry dates. In the Humira biosimilar market, six companies agreed to enter between 2023 and 2025-spreading out competition to avoid a price crash. That’s not free market. That’s collusion disguised as compliance.What’s Next for the Generic Market?

The industry is shrinking. The number of companies holding generic drug approvals dropped from 142 in 2018 to 97 in 2022. Why? Because it’s too risky. Too many players entered simple generics. Prices crashed. Profits vanished. Companies folded. Others merged. By 2027, experts predict that 70% of simple generics will have five or more competitors, with prices at 10-15% of the brand. But complex generics? They’ll still have only two or three players, with prices at 30-40%. And authorized generics? Half of all top-selling drugs will have one by then. The system is broken. Too many companies chase too few profitable drugs. The ones that survive are either the best at making cheap pills or the smartest at avoiding the race to the bottom.What This Means for Patients

You might think more generics = better access. And sometimes, yes. But when manufacturers can’t make money, they stop making the drug. Shortages spike. Patients go without. And when prices drop too fast, companies cut corners on quality. The result? A system that delivers cheap drugs-but not always safe ones. The real question isn’t how many generics enter. It’s how many can stay in business long enough to keep the supply flowing.What is the 180-day exclusivity period for generic drugs?

The 180-day exclusivity period is a legal incentive under the Hatch-Waxman Act that gives the first generic company to successfully challenge a brand drug’s patent the exclusive right to sell that generic for six months. During this time, no other generic can enter the market, allowing the first entrant to capture 70-80% of sales at prices near the brand level.

How do authorized generics affect the first generic market?

Authorized generics are made by the original brand company and sold under a generic label. When launched during the first generic’s exclusivity period, they can capture 30-40% of the market, reducing the first generic’s share from 70-80% to 40-50%. This slashes revenue and undermines the financial incentive for patent challenges.

Why do generic drug prices drop so fast after multiple entrants?

Each new generic entrant lowers prices to win contracts with pharmacy benefit managers (PBMs) and retailers. The FDA found that prices fall to 66% of brand with two generics, 49% with three, and stabilize at 17% with five or more. The steepest drop happens between the second and third entrants, as competition shifts from exclusivity to volume.

What causes generic drug shortages after multiple entries?

When prices collapse, manufacturers lose profit margins. Many rely on shared contract manufacturing organizations (CMOs) to cut costs. If one CMO has a quality issue, production halts across multiple generics. The FDA reports that 62% of shortages occur in markets with three or more manufacturers.

Why do some generic companies avoid entering the market?

High litigation costs, the risk of authorized generics, unpredictable PBM contracts, and thin margins make entry unattractive. Many companies now focus on complex generics (like injectables) or exit the market entirely. The number of active generic manufacturers fell from 142 in 2018 to 97 in 2022.

How do pharmacy benefit managers (PBMs) influence generic competition?

PBMs control which generics get placed on insurance formularies. In 68% of contracts, they use a "winner-take-all" model, awarding 100% of formulary placement to the lowest bidder. This means the first generic to sign a contract-even if not the first to be approved-captures 80-90% of the market, sidelining competitors regardless of FDA approval order.

Bobby Collins

January 1, 2026 AT 16:27They're letting Big Pharma run the show through backdoor deals. Authorized generics? That's not competition-that's a rigged game. The brand company just puts out the same pill under a different label and laughs all the way to the bank. And PBMs? They're just middlemen who don't care if you live or die, as long as they get their cut. This isn't capitalism. It's feudalism with pill bottles.

Layla Anna

January 1, 2026 AT 16:32omg i had to pay $200 for my blood pressure med last year 😭 then last month it dropped to $5 and i was like wait what?? but then my pharmacy said they ran out and now it's back to $40?? like whyyyy?? i just want to not go broke taking my meds 🙏

Heather Josey

January 2, 2026 AT 02:12While the dynamics described are complex and concerning, it's important to recognize that the generic drug system, despite its flaws, has saved American families billions in healthcare costs. The challenge lies not in dismantling the system, but in reforming it-ensuring transparency in PBM contracts, curbing anti-competitive practices like authorized generics, and incentivizing sustainable manufacturing. We can do better without abandoning the progress we've made.

Donna Peplinskie

January 3, 2026 AT 08:09I really appreciate how you broke this down-it’s so easy to think, 'more generics = cheaper drugs,' but the reality is so much messier... And honestly, the part about contract manufacturers? That kept me up last night. If one lab messes up, *everyone* loses. That’s not just a business problem-it’s a public health crisis waiting to happen. We need to treat drug manufacturing like infrastructure, not a commodity.

Olukayode Oguntulu

January 4, 2026 AT 01:16Let’s deconstruct the epistemological underpinnings of pharmaceutical commodification. The 180-day exclusivity paradigm is a neoliberal artifact-a performative gesture toward market efficiency that obscures the ontological violence of patent law. The authorized generic is not merely a competitive tactic; it is the reification of capital’s dialectical sublation of innovation. The PBM, as a technocratic intermediary, mediates the alienation of the patient-consumer from the pharmacological sublime. In this schema, the 'race to the bottom' is not a market failure-it is the inevitable culmination of late-stage capitalist pharmacopoeia.

jaspreet sandhu

January 5, 2026 AT 18:07You think this is bad? In India we have 50 companies making the same pill and it costs 50 cents. No one cares about formularies or PBMs. We just make it and sell it. Americans overcomplicate everything. You have lawyers writing drug rules instead of doctors. You have companies making the same drug and calling it 'authorized' like it's some special version. It's the same chemical. Why are you paying $10 for something that should be 50 cents? This whole system is broken because you let corporations write the rules.

Alex Warden

January 6, 2026 AT 21:54It's time to stop letting foreign manufacturers control our medicine supply. We used to make 80% of our generics in the U.S. Now it's 20%. China and India are running the show and they're cutting corners. That's why we have shortages. We need tariffs on foreign generic drugs and tax breaks for American-made pills. This isn't about prices-it's about national security.

LIZETH DE PACHECO

January 7, 2026 AT 09:27This is such an important conversation. I’ve seen patients cry because their insulin went from $30 to $300 overnight. But I’ve also seen them breathe easier when a generic finally hits the market. It’s not perfect, but we need to fix the system-not give up on it. Maybe we need public manufacturing options? Or a nonprofit PBM? We can do this. We just need to stop treating medicine like a stock ticker.

Lee M

January 8, 2026 AT 08:50The real issue isn’t authorized generics or PBMs-it’s that we’ve turned healthcare into a profit-driven industry instead of a public good. The 180-day exclusivity period is a band-aid on a bullet wound. Until we decouple medicine from shareholder value, nothing changes. The market doesn’t care if you die. It only cares if you pay.

Kristen Russell

January 8, 2026 AT 21:24So we need better rules, not fewer generics. Let’s fix the system, not give up on it.